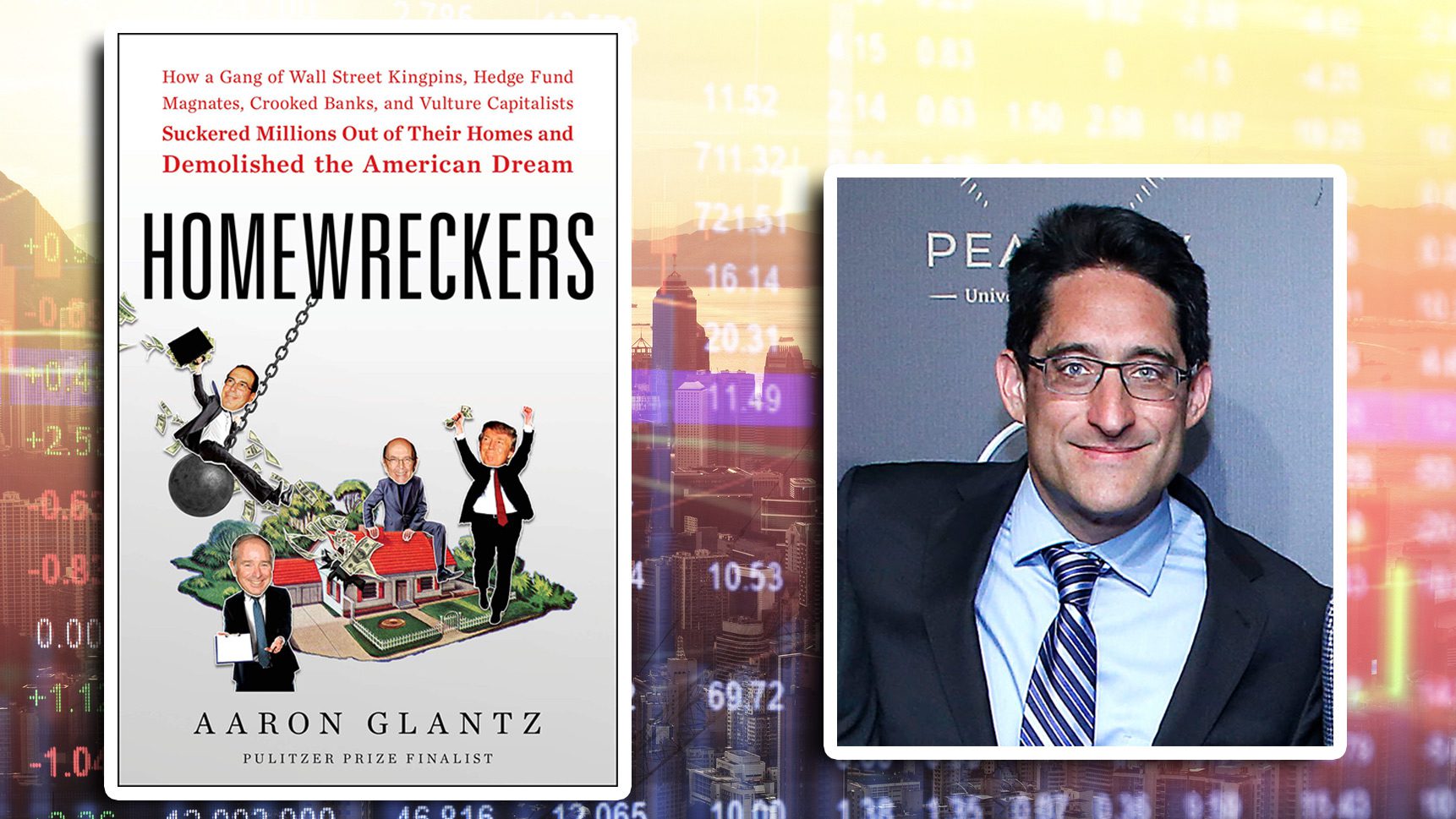

Kanok Sulaiman/Getty Images; John Lamparski/WireImage;

More than 10 years after the housing crash that devastated the economy, people are still debating just what happened. A new book tries to make sense of it all, and whether we’re heading for another disaster.

Although the economy and the housing market have made a comeback, homeownership remains low, and fears of another real estate meltdown linger. Aaron Glantz, a prize-winning investigative journalist at Reveal News, set out to explain why, in “Homewreckers: How a Gang of Wall Street Kingpins, Hedge Fund Magnates, Crooked Banks, and Vulture Capitalists Suckered Millions Out of Their Homes and Demolished the American Dream.”

Glantz talked with realtor.com® about the research that went into his book, and what motivated him to write it. Here are some of his surprising revelations, and advice for regular homeowners on how to protect themselves from whatever the future may bring.

Custom House

Q: Who, in your opinion, are the ‘homewreckers’?

Eight million Americans lost their homes in the bust. Where did those homes go? Those houses didn’t just disappear. Who won, when everyone else lost? The people who won—a small group of businessmen who pounced to seize thousands of homes and made billions of dollars—they’re the “homewreckers.”

Q: The housing crash started over 10 years ago. Why are you writing about it now?

The reason that I started to write is that I noticed the economy is supposedly going so well, unemployment is low, the stock market is up. But even though the housing bust is over, the nation’s homeownership rate is at its lowest in 50 years, and continues to go down. It helps explain why people feel so uneasy.

People are still arguing about what happened in 2008. This is the first story that advances us to 2017. This is the movie that comes after. That story has not been told.

Q: What stories from homeowners you interviewed stand out in your mind as the most haunting?

The main character I followed throughout the book, Sandy Jolly, her parents owned their home for more than 30 years. As they were getting old and sick, they were sitting at home watching TV, and they saw an ad with James Garner, one of their favorite actors, portraying reverse mortgage as basically free money.

But there was a catch. Yes, this family tried it and got an $85,000 lump sum, in addition to having their $120,000 home loan paid off. But every month, the mortgage got bigger. The bank tacked on money and fees. Eventually, Sandy lost the house, and ended up renting it from the bank, which took over the homes of 23,000 borrowers with reverse mortgages. For the great majority, it was a disaster.

Q: What happened to this house after the bank took it over?

Sandy fought for 10 years, arguing that her parents were defrauded. And she eventually won an $89 million whistleblower settlement against the bank. But we can’t all be like Sandy. We need to have some real systemic change in this county.

As long as the unemployment rate is low and people have jobs and they can afford rents, the financial market is secure. If people lose their jobs, what’s going to happen? We could be back in another housing bust.

Q: How important is homeownership to Americans today?

It is absolutely critical. The average American homeowner is worth $200,000, which is 100 times more than the average renter, and this is not because homeowners make 100 times more than renters. For most middle-class families, home ownership is the only way to save money.

The Brookings Institute found that that the typical family spends 80% of their cash on just five things, and housing is the only thing that doesn’t disappear when you spend the money. Food is eaten, gas is burned in your car. Housing is the only thing we do that can actually save money.

Only 20% of Americans own stock or mutual funds. The average family only has $4,000 in the bank. As a country, we are living paycheck to paycheck. If we’re spending 30% to 40% of our income on housing, we can’t save money. If we pay it to a landlord, our landlord is getting that benefit.

Q: How do people feel about housing right now?

I think that people have a sense right now there’s a real crisis of affordability. People think we don’t have enough inventory because we haven’t built enough houses. Only 10 years ago, our country was awash in real estate. I think that we have to ask ourselves if we really have a housing shortage, or if we have rigged the market so it only benefits a few of the players.

Q: How do you think the system needs to change?

It really depends on the situation. I’m sitting in San Francisco, where the median home price is $1 million; another person is in Detroit, where real estate is cheap because nobody can get loans. We need the government to really advocate on behalf of families that are trying to get loans. Right now, they are advocating on behalf of LLC, LLP, and LP shell companies. We now have millions of homes owned by shell companies.

Q: What government efforts were made during the crash to help homeowners facing foreclosure?

They were coming up with loan modification programs, where the government would be an active player. Instead, the Bush and Obama administrations bailed out the banks and trusted they would pass some of that onto the consumer. Those programs were very complicated, they were hard to access. The problem was that the government had already given the money, instead of helping the consumer themselves.

Q: What are a couple of ways government intervention has helped with homeownership in the past?

I write a lot about what President [Franklin D.] Roosevelt did during the Depression. At that time, there was no such thing as a fixed-rate, long-term mortgage, so Roosevelt invented it. When people did lose their homes to foreclosure, they were then sold to families. At the end of the day, the government made money on this, because even during the Depression, families were able to pay off their homes.

We also had the GI bill, a massive government lending program.

Q: How did the new tax codes impact homeownership?

[The government] curtailed the home mortgage deduction. They made it cheaper to be a corporate landlord, to own a house through a shell company. They wanted to give a big tax cut to the homewreckers, so they did. They took it out of families who own their own house. If you’re thinking: “Should I become a homeowner? Prices are high, can I afford that mortgage payment?” now you have to factor in that you’re not getting the tax benefit you used to. That could be the difference between being a homeowner and being a renter.

Q: Do you have any take-home lessons for home buyers today?

I’m noticing the return of the same bad mortgage products. If you look at data released recently, you would see lots of negative amortization loans. There are hundreds of these bad loans. Be very careful. If a salesman calls or comes to your home, or if you see an ad that sounds too good to be true, it probably is.

The post Another Housing Crisis Ahead? New Book, ‘Homewreckers,’ Says It Could Happen appeared first on Real Estate News & Insights | realtor.com®.

source https://www.realtor.com/news/trends/another-housing-crisis-ahead-new-book-homewreckers-says-it-could-happen/

No comments:

Post a Comment